Comprehensive Financial Advice and Financial Planning Services

DMG Advice is a full-service financial planning firm backed by one of the best financial support networks in the country. Our principle objective is to make high quality financial advice more accessible and affordable to the local community. We aim to be the financial planning firm of choice for retirees and pre-retirees in the local community.

At DMG Advice, we enjoy helping our clients maximise their financial potential, and live the kind of lifestyle they want to live both now and in retirement. We aim to help our clients develop a holistic financial plan tailored to their individual needs so they can achieve financial success.

The objective for all our clients is to get the right money into the right structures at the right time with the least amount of risk. So, whether you are currently receiving advice or not, if you are looking to make the most of your financial situation, we can help.

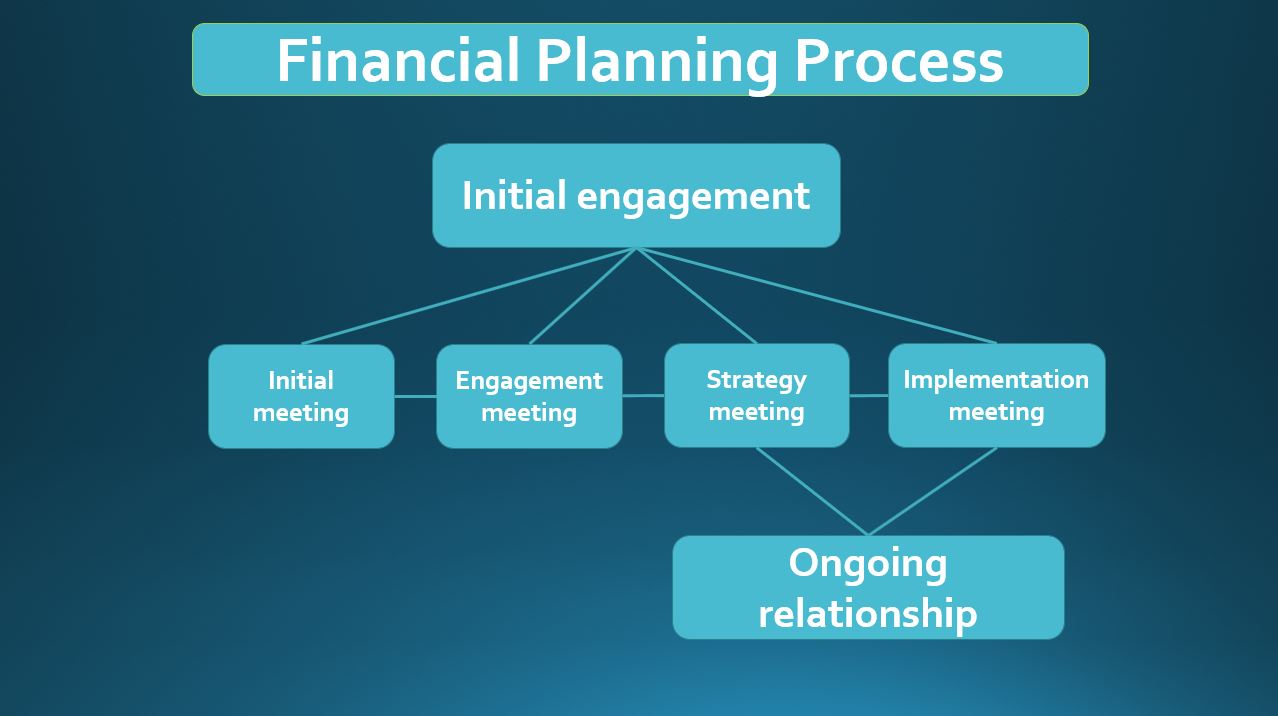

The first client appointment is at our expense and we use this opportunity to get to know you and your reasons for seeking financial advice. During the initial engagement process, we usually provide prospective clients with an outline of the scope of work required to get their financial house in order, together with our fees. Potential clients are then able to make an informed decision about whether they want to go ahead or not.

Clients who decide to join us and obtain financial advice, will also be offered the opportunity to enter an ongoing financial planning relationship with DMG Advice.

The first client appointment is at our expense and we use this opportunity to get to know you and your reasons for seeking financial advice.

tailored financial solutions

that maximise outcomes

Peace of Mind

professional advice

make informed decisions

clarity & understanding

financial education

stay disciplined

protect my assets

a living I can afford

$$$

Ongoing Financial Planning Relationship

Your ongoing financial planning relationship with DMG Advice is an important part of the financial planning process. During this time we will ask you to formally review your lifestyle and financial goals, and “retest” your financial strategy in light of your goals and objectives, as well as any personal or legislative changes that may have occurred.

As part of our ongoing financial planning relationship, we will review your strategy and the performance of your investments and provide you with a number of benefits including:

- ongoing adviser access and communications,

- strategy and/or product recommendations,

- portfolio management and administration services,

- regular reporting on your investments; and

- invitations to client seminars and functions.

The benefits of becoming a client of DMG Advice

Our clients value highly the financial planning relationship. We are able to provide our clients with the peace of mind of knowing that they are making the most of their financial position by addressing their most pressing concerns, including:

- How much money will I need to save for retirement & how do I go about it?

- How do I protect myself & my assets?

- When can I retire?

- When will I be eligible for Centrelink Age Pension and what will my entitlements be?

- What standard of living can I afford in retirement?

- How long will my money last in retirement?

Financial Planning Strategy Areas

As financial planners, we work in a number of different areas. Although we specialise in retirement planning, we are also authorised to provide advice on the following:

- Cash Flow & Debt Management

- Wealth Structures

- Wealth Accumulation

- Superannuation

- Tax Strategies

- Income & Asset Protection

- Government Benefits; and

- Estate Planning

and to provide financial advice and deal in the following financial products:

- Basic Deposit Products

- Non-basic Deposit Products

- Life Products – Investment Life Insurance

- Life Products – Life Risk Insurance

- Superannuation

- Retirement Savings Accounts

- Managed Investment Schemes, including Investor Directed Portfolio Services (IDPS)

- Government Debentures, Stocks or Bonds

- Securities

- Standard Margin Lending Facilities

Why choose DMG Advice for your Financial Planning needs?

- We believe in the difference professional advice can make to our clients

- We offer our clients the opportunity to get their financial house in order

- We do this by providing tailored solutions to their financial problems in order to maximise outcomes

- We give our clients peace of mind, somewhere to turn to when they need help

- We act as their financial guardian so they can make informed decisions, not poor ones

- We offer our clients a financial education, clarity & understanding on complex financial concepts

- We keep our clients accountable for their actions to ensure they stay disciplined

At the end of the day, we believe that people who receive financial advice are far better off in the long run than people who don’t, because you don’t know what you don’t know.

People trust us with their life savings, and we do our best to manage the wealth of our clients in a very transparent and cost effective way. So, if you are looking to get your financial house in order in preparation for retirement, make an obligation free appointment to come and talk to us, we would be happy to help out.

We’d Love to Help You With Your Tailored Financial Plan

At DMG Advice Albury our mission is to provide sound & balanced financial advice for a professional fee. We believe that providing financial advice and selling investment products are totally separate endeavours. Quality advice is compromised if it is driven by the need to “sell” product. As such, we seek out and prefer to recommend investments that do not pay us commissions, meaning you incur lower investment costs and the ability to achieve higher investment returns.

Our aim is to make financial advice more accessible and more affordable to all our valued clients. Our fee arrangements are therefore structured around an agreed flat dollar fee for service offering which separates the advice function from any product recommendations. This allows us to offer you certainty in terms of our fees and provide you with strategic financial planning advice that is not compromised by a system of commissions, incentives and conflicts of interest.

Please refer to our Financial Services Guide (FSG) for more information on our fee structure.